Peppol e‑invoicing for UK construction suppliers: Xero and QuickBooks setup, buyer onboarding and getting paid faster

Peppol e‑invoicing for UK construction suppliers: Xero and QuickBooks setup, buyer onboarding and getting paid faster

Category: Integrations • Niche: e‑invoicing, Peppol, NHS suppliers, main contractor supply chain, Xero, QuickBooks

Contents

- Quick answer

- Who this is for

- What Peppol is (in plain English)

- Is e‑invoicing mandatory in the UK?

- Xero setup: send and receive over Peppol

- QuickBooks options: connect via a Peppol provider

- Buyer onboarding (NHS and main contractors)

- Build a simple AP/AR workflow that saves you hours

- Troubleshooting and gotchas

- What are people saying on Reddit?

- FAQ

Quick answer

- If you supply an NHS trust, you are expected to send EN 16931‑compliant e‑invoices, typically via the Peppol network. Many main contractors are moving the same way.

- Xero UK has native Peppol e‑invoicing. QuickBooks UK usually needs a third‑party Peppol connector.

- Benefits: faster processing, fewer rejections, better payment discipline under the Procurement Act 2023 30‑day terms.

Useful links: OpenPeppol, UK consultation on promoting e‑invoicing, Cabinet Office e‑invoicing guidance.

Who this is for

- Subcontractors and suppliers to NHS trusts or councils

- SMEs in Tier 2/3 of big construction supply chains

- Office managers or bookkeepers using Xero or QuickBooks

What Peppol is (in plain English)

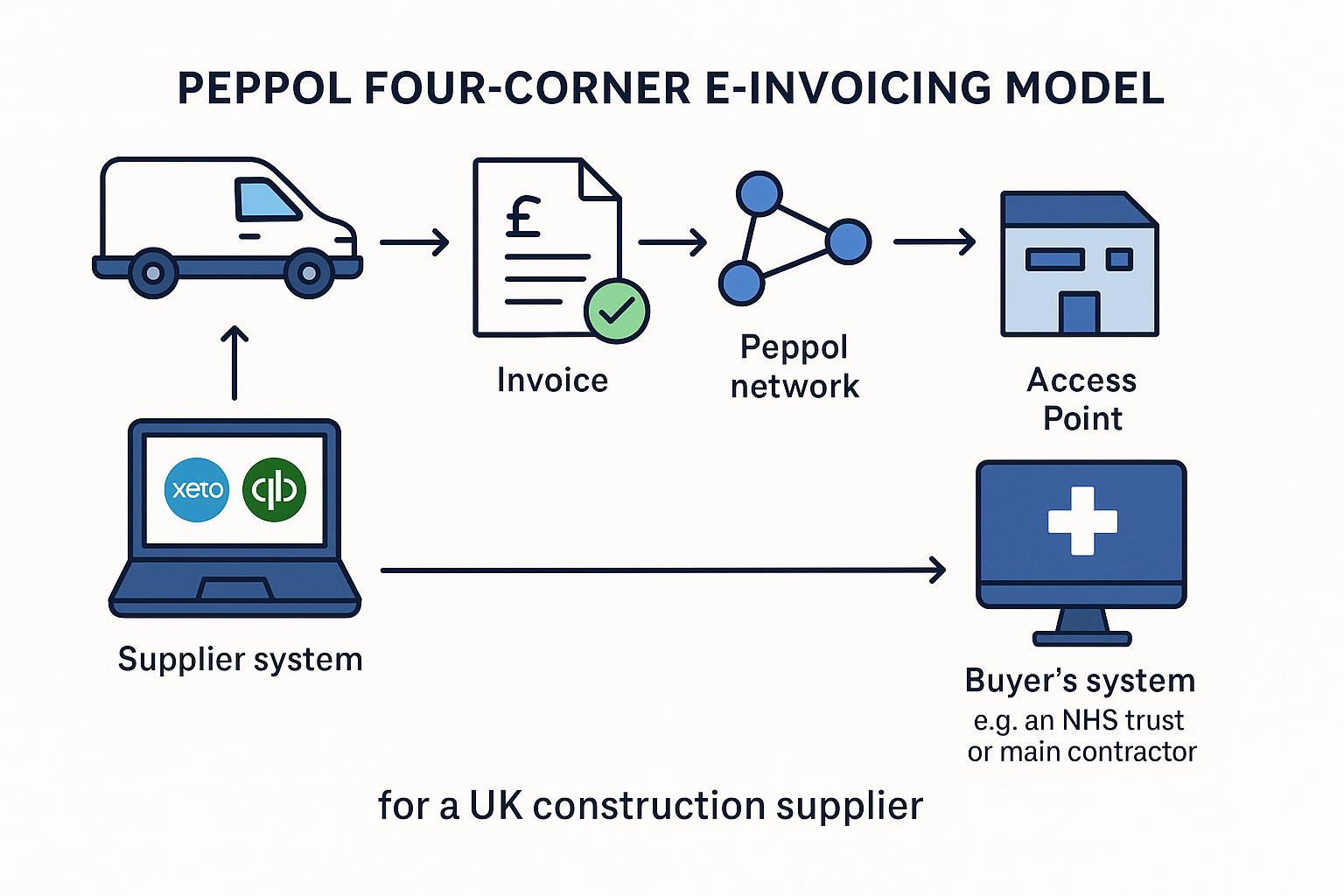

Peppol is a shared network for sending invoices and orders between businesses. Think of it like the post: you hand the invoice to your local “Access Point” and it delivers to the buyer’s Access Point. Everyone uses the same standard, so their system can read it automatically.

- Standard: EN 16931 (UK recognises this standard for public contracts)

- Model: “four‑corner” (your system → your Access Point → their Access Point → their system)

- Directory: you can look up if a buyer is on Peppol via the Peppol Directory

Learn more: OpenPeppol

Is e‑invoicing mandatory in the UK?

- Public sector: Authorities must accept EN 16931 e‑invoices. NHS suppliers commonly use Peppol. See the Public Procurement (Electronic Invoices etc.) Regulations 2019 and Procurement Act 2023 guidance on electronic invoicing and payment.

- Private sector: Voluntary for B2B, but adoption is rising, especially with large contractors.

- Policy trend: HMRC/DBT ran a 2025 consultation on wider take‑up. Read the consultation overview.

Xero setup: send and receive over Peppol

Xero UK supports Peppol e‑invoicing natively.

Steps (high level):

- In Xero, enable e‑invoicing and complete registration so your business appears on the Peppol network. See Xero’s UK page on e‑invoicing.

- Validate your organisation details (legal name, VAT, address) to match what buyers expect.

- To send: create an invoice as normal and choose e‑invoice when the customer is Peppol‑enabled.

- To receive: share your Peppol details with suppliers so their Access Point can route invoices into Xero.

Tip: Xero acquired Tickstar (an Access Point provider). That’s the underlying Peppol connection. Background blog: Introducing eInvoicing in the UK.

QuickBooks options: connect via a Peppol provider

QuickBooks Online UK doesn’t currently advertise native Peppol for B2B. Many firms plug in a service provider (Access Point) that integrates to QBO.

Options to explore:

- Check Intuit community guidance and confirm current status with QuickBooks support.

- Consider third‑party connectors that bridge QBO to Peppol (evaluate security, support and UK suitability).

References: Intuit community thread on EU e‑invoicing support, and example Peppol connector sites for QBO to research.

Buyer onboarding (NHS and main contractors)

Before you send your first e‑invoice, ask the buyer for:

- Their Peppol ID (or confirm if they accept via NHS Supply Chain routes)

- Required fields (project code, PO, cost centre, delivery address, contact)

- Syntax and attachments (EN 16931, approved syntaxes are listed in Cabinet Office guidance)

Useful context:

- NHS: GS1 barcoding and Peppol have been policy direction for a decade. Onboarding varies by trust. Start with Procurement/AP. See the NHS e‑procurement policy paper and England NHS profile.

- Procurement Act 2023: public buyers must accept and process e‑invoices and pay in 30 days.

Build a simple AP/AR workflow that saves you hours

- Create job in your job system (Tradify/ServiceM8/Commusoft etc.) with PO and site details.

- Raise invoice in Xero/QBO with the exact buyer references.

- Send as Peppol e‑invoice. Set an automation to nudge unpaid invoices at 7, 14 and 21 days.

- Receipts and materials: use receipt OCR tools (e.g. Dext) to code purchases back to the job.

- Bank feed: reconcile payments fast; flag disputes early.

Related Academy reads:

- Quote follow‑up cadence to lift conversions

- Chase unpaid invoices with scripts and automations

Troubleshooting and gotchas

- Invoice rejected: usually missing PO, wrong VAT ID, or non‑EN 16931 fields. Fix and resend.

- You can only receive from one Access Point at a time. If you change provider, update your registration.

- Attachments: keep them lean; buyers often prefer links to O&M packs.

- Test mode: ask buyers if they have a UAT or test recipient to validate first.

What are people saying on Reddit?

- Useful explainer on using different Access Points for send vs receive (video):

FAQ

Is Peppol the same as e‑invoicing?

Not exactly. E‑invoicing is the concept; Peppol is one network and set of specs many organisations use to exchange those invoices.

Do I need Peppol to invoice UK public bodies?

Not strictly. The UK requires EN 16931 e‑invoices in an approved syntax. Many public bodies, especially in health, use Peppol to achieve this.

Does Xero support Peppol in the UK?

Yes, Xero UK supports Peppol e‑invoicing. See Xero’s UK e‑invoicing page.

Does QuickBooks support Peppol in the UK?

QuickBooks Online UK typically needs a third‑party Peppol connector. Confirm the current position with Intuit before you commit.

Will this help me get paid faster?

Often, yes. E‑invoices land straight into the buyer’s AP system with fewer mistakes, which supports the Procurement Act’s 30‑day payment requirement.

Want to slash training times and increase revenue per Engineer? Join our Waitlist: https://trainar.ai/waitlist

Share this article

Category

Connect your tools and workflows

Ready to Transform Your Business?

Join the TrainAR beta and start using AR training in your business.

Join Beta ProgramStay Updated

Get weekly insights and new articles delivered to your inbox.

Comments (0)

Leave a Comment

No comments yet

Be the first to share your thoughts on this article!

Related Articles

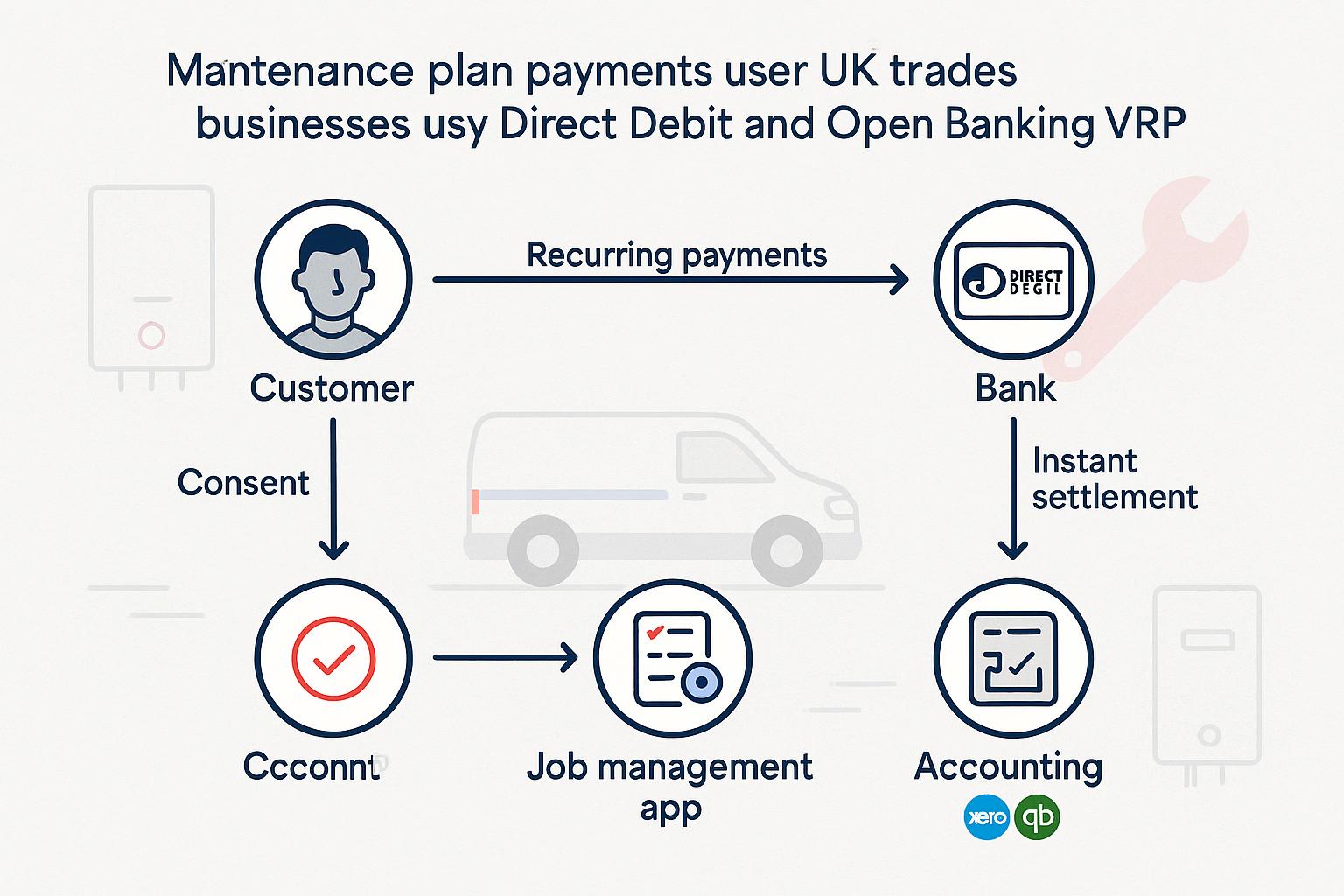

Maintenance plan payments for trades: Direct Debit vs Open Banking VRP, setup and when to switch

Category: Integrations • Niche: payments, open banking, Direct Debit, maintenance plans, Xero, QuickBooks <img src="https://vpzqhqqkbkbzibzvzuxv.s...

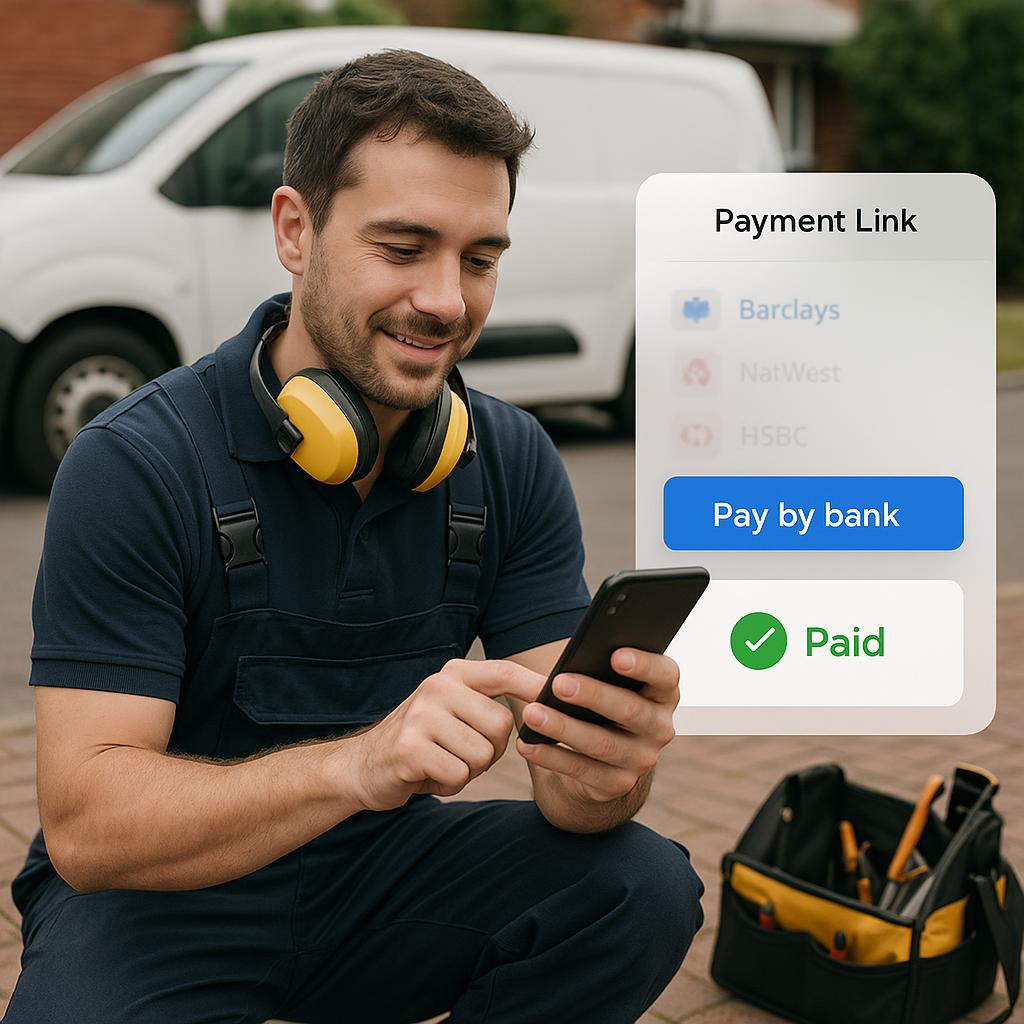

Pay by bank links for trades: setup with Stripe or GoCardless, fees, refunds and clean Xero/QuickBooks reconciliation

Pay by bank links for trades: setup with Stripe or GoCardless, fees, refunds and clean Xero/QuickBooks reconciliation Category: Integrations • Nic...

Square to Xero reconciliation: clean UK setup with a clearing account and correct VAT on fees

Square to Xero reconciliation: clean UK setup with a clearing account and correct VAT on fees Category: Integrations • Niche: payments, reconcilia...

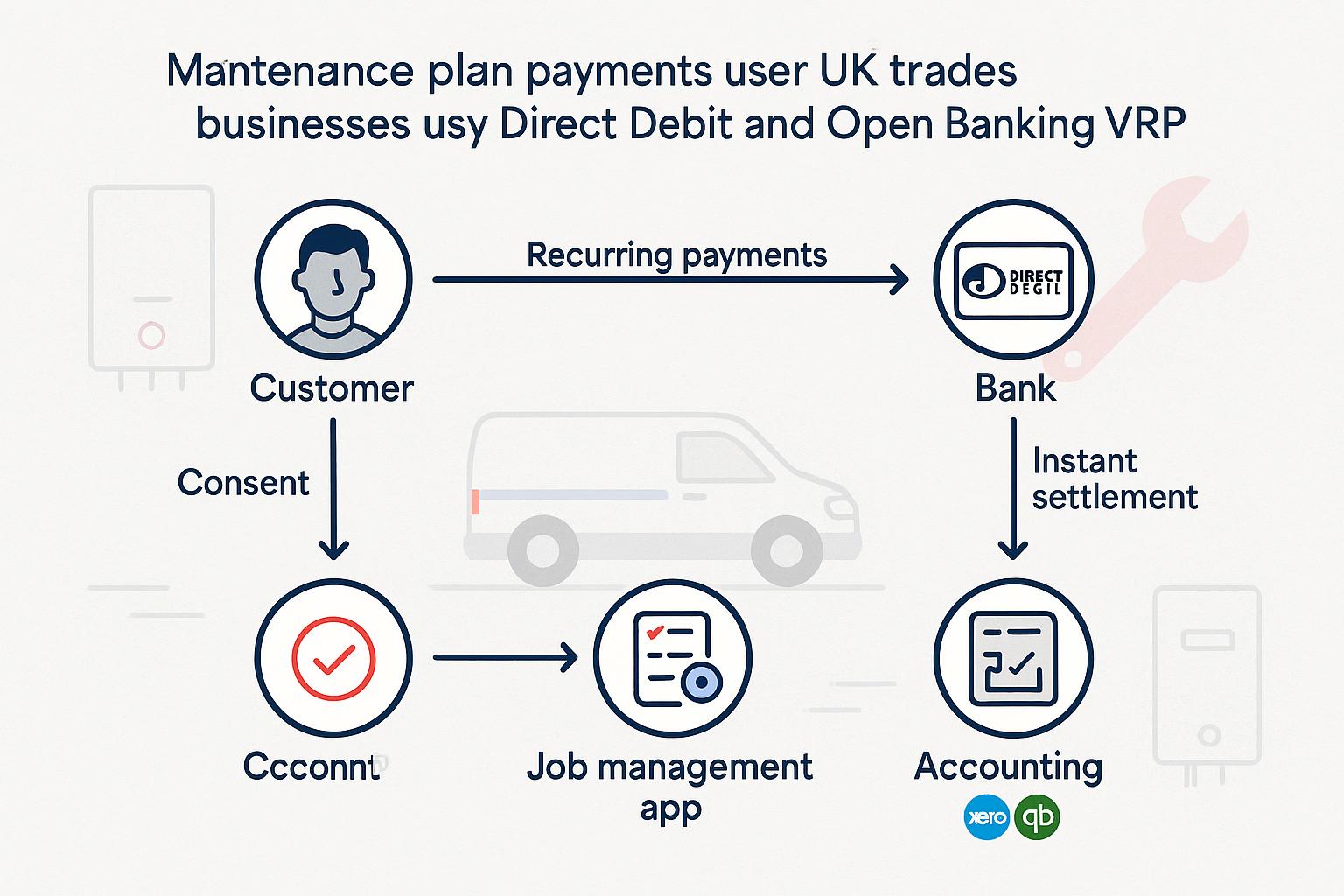

Maintenance plan payments for trades: Direct Debit vs Open Banking VRP, setup and when to switch

Category: Integrations • Niche: payments, open banking, Direct Debit, maintenance plans, Xero, QuickBooks <img src="https://vpzqhqqkbkbzibzvzuxv.s...

Pay by bank links for trades: setup with Stripe or GoCardless, fees, refunds and clean Xero/QuickBooks reconciliation

Pay by bank links for trades: setup with Stripe or GoCardless, fees, refunds and clean Xero/QuickBooks reconciliation Category: Integrations • Nic...

Square to Xero reconciliation: clean UK setup with a clearing account and correct VAT on fees

Square to Xero reconciliation: clean UK setup with a clearing account and correct VAT on fees Category: Integrations • Niche: payments, reconcilia...