13‑week cash flow for trades: simple UK template with CIS, VAT and retentions

13‑week cash flow for trades: simple UK template with CIS, VAT and retentions

Category: Finance & Tax • Niche: cash flow, CIS, VAT, retentions, Xero/QuickBooks

Contents

- Why 13 weeks and who this helps

- What to include for a UK construction business

- The 30‑minute setup (spreadsheet or Google Sheets)

- Weekly update routine

- Worked example

- Automations to save time

- Useful links

- FAQ

Why 13 weeks and who this helps

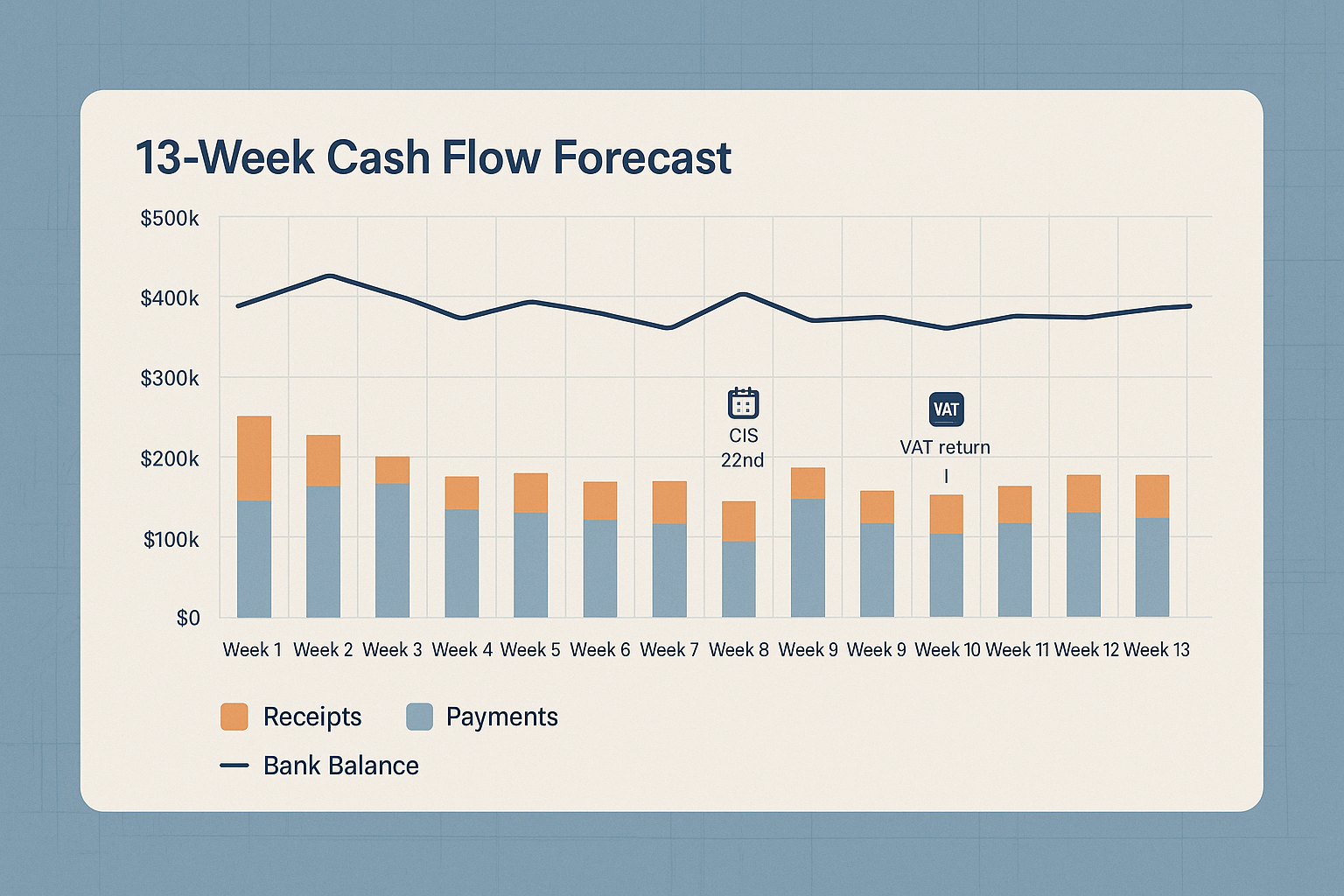

A 13‑week cash flow is short, sharp and practical. One calendar quarter lets you see pinch points in time to act, without getting lost in long‑range guesses. It’s the format banks and insolvency practitioners expect, and it suits UK trades firms where cash is dominated by:

- Valuations and payment cycles

- CIS deductions to HMRC

- VAT timing (including Domestic Reverse Charge)

- Retentions held and released

- Weekly payroll and plant/material spend

If you do small works, maintenance or project contracting, this model fits. You can keep it in a simple sheet and update it once a week.

What to include for a UK construction business

Build these tabs or sections in your sheet:

- Assumptions: VAT quarter, VAT rate, DRC yes/no per project, CIS rates for each subcontractor, bank opening balance, overdraft limit

- Projects and valuations: one row per certificate with date, amount, retention %, due date, expected pay week

- Retentions ledger (both sides): receivable from your client; payable to subs; release 50 percent at PC, 50 percent at end of defects period

- Accounts receivable schedule: receipts by week, net of retention, VAT logic based on DRC

- Accounts payable schedule: subcontractors split into labour vs materials, CIS calculated on labour; include retention you hold back

- HMRC timing: CIS paid by the 22nd following month; PAYE/NIC by the 22nd; VAT return payment or refund one month and 7 days after quarter end

- Overheads and finance: fuel, vans, insurance, software, finance costs, lease payments

- 13‑week summary: opening, total receipts, total payments, closing balance, headroom

CIS and VAT notes that affect cash

- CIS is deducted from the labour element of subbie invoices only. Materials and plant they’ve paid for and itemised are outside the CIS deduction. You pay HMRC the CIS you withheld by the 22nd of the following month.

- Domestic Reverse Charge (DRC) often applies for construction services between VAT‑registered businesses in the chain. When DRC applies, you don’t receive or pay VAT cash on those services. Only include VAT cash where VAT is actually paid or collected (e.g., merchants, fuel, services outside DRC).

See HMRC: Construction Industry Scheme and VAT reverse charge for construction.

The 30‑minute setup (spreadsheet or Google Sheets)

- Dates first. Create columns Week 1 to Week 13 with real week‑commencing dates.

- Opening balance. Put today’s bank balance in Week 1 opening.

- Receipts. From your valuations table, bring in expected payment weeks and amounts net of retention. Add separate rows for retention releases, variations and VAT refunds.

- Payments. From your AP table, bring in suppliers, plant, fuel, payroll, CIS to HMRC, PAYE/NIC, VAT.

- Closing balance. Opening + receipts − payments. Add headroom by including overdraft or facility limits.

- Controls. Add quick checks: AR receipts tie to certificates net of retentions; AP payments tie to invoices; CIS owed for the month equals the HMRC payment on the 22nd.

Column ideas you can copy‑paste

- AR: Project | Cert date | Cert amount | Retention % | Retention this cert | Net payable | Due date | Expected pay week | Cash in week

- AP: Supplier | Date | Labour | Materials | CIS rate | CIS amount | Retention % | Retention this valuation | VAT cash | Pay week | Cash out week | CIS month | HMRC cash week (22nd)

- Retentions: Receivable/Payable | Counterparty | % | Cumulative retained | PC date | Release 1 amount/date | DLP end | Release 2 amount/date | Status

Weekly update routine

- Replace last week’s forecast with actuals from the bank feed

- Roll the plan forward one week so it always shows 13 weeks ahead

- Re‑age any late customer payments; apply a “slippage” rule if needed (e.g., 20 percent slip by one week)

- Tick off any retention releases due and re‑plan if snagging delays PC or making good defects

- Verify subcontractor CIS status monthly; adjust 0 percent, 20 percent or 30 percent rates

Worked example

- Client pays monthly on the 30th, 30 days after the due date. September certificate is £200,000. Retention 5 percent = £10,000. You expect £190,000 cash in early November. The £10,000 retention goes to receivables: £5,000 due at PC plus terms; £5,000 due at DLP end plus terms.

- Subcontractor invoice for the same work is Labour £50,000, Materials £20,000. DRC applies, so no VAT cash. CIS at 20 percent on labour = £10,000. Cash you pay the sub in early November is £60,000. CIS you owe HMRC for that month is £10,000 on 22 December.

- Your 13‑week shows an early November pinch point. You either bring forward invoicing, part‑bill variations, or delay non‑critical spends. The model makes the decision obvious.

Automations to save time

- Xero: Use bank rules and repeating journals to tag cash by job and cost type. Xero Projects can help tie timesheets and purchases back to margin.

- QuickBooks: Use custom fields to track job names on bills and receipts; build saved reports for job P and L and weekly cash.

- OCR tools: Dext or AutoEntry can split labour vs materials on subbie bills to drive CIS correctly.

- Alerts: A simple Zapier or Make scenario can email you when forecast headroom drops below a threshold in any week.

For related reading in this Academy, see: Automate supplier quotes and POs with Xero and Xero and QuickBooks: set up PAYE payroll and CIS subcontractors properly.

Useful links

- HMRC CIS: what contractors and subcontractors must do — https://www.gov.uk/what-you-must-do-as-a-cis-subcontractor-and-contractor

- HMRC VAT reverse charge: technical guide — https://www.gov.uk/guidance/vat-reverse-charge-technical-guide

- RICS cash flow forecasting guidance note — https://www.rics.org/content/dam/ricsglobal/documents/standards/cash_flow_forecasting_1st_edition_rics.pdf

- GOV.UK cash flow forecast template (generic) — https://assets.publishing.service.gov.uk/media/5a7fa357ed915d74e33f7a6c/cash-flow-forecast-template.xls

FAQ

Call to action: Want to slash training times and increase revenue per Engineer? Join our Waitlist: https://trainar.ai/waitlist

Share this article

Category

Financial management and tax guidance for trades

Ready to Transform Your Business?

Join the TrainAR beta and start using AR training in your business.

Join Beta ProgramStay Updated

Get weekly insights and new articles delivered to your inbox.

Comments (0)

Leave a Comment

No comments yet

Be the first to share your thoughts on this article!

Related Articles

Cash flow forecasting for trades in Xero or QuickBooks: simple setup, open banking tips and a one‑page template

Cash flow forecasting for trades in Xero or QuickBooks: simple setup, open banking tips and a one‑page template Category: Finance & Tax Niche: ca...

Offer finance to customers: interest‑free plans vs Kanda, Vendigo and Novuna explained

Offer finance to customers: interest‑free plans vs Kanda, Vendigo and Novuna explained Category: Finance & Tax • Niche: customer finance, interest...

How to add ULEZ or Clean Air Zone charges to your invoice (VAT and reverse charge explained)

Category: Finance & Tax • Niche: VAT, ULEZ/CAZ, invoicing, domestic reverse charge, job costing, Xero, QuickBooks Contents {#contents} - Quick an...

Cash flow forecasting for trades in Xero or QuickBooks: simple setup, open banking tips and a one‑page template

Cash flow forecasting for trades in Xero or QuickBooks: simple setup, open banking tips and a one‑page template Category: Finance & Tax Niche: ca...

Offer finance to customers: interest‑free plans vs Kanda, Vendigo and Novuna explained

Offer finance to customers: interest‑free plans vs Kanda, Vendigo and Novuna explained Category: Finance & Tax • Niche: customer finance, interest...

How to add ULEZ or Clean Air Zone charges to your invoice (VAT and reverse charge explained)

Category: Finance & Tax • Niche: VAT, ULEZ/CAZ, invoicing, domestic reverse charge, job costing, Xero, QuickBooks Contents {#contents} - Quick an...