Finance & Tax

Financial management and tax guidance for trades

Cash flow forecasting for trades in Xero or QuickBooks: simple setup, open banking tips and a one‑page template

Cash flow forecasting for trades in Xero or QuickBooks: simple setup, open banking tips and a one‑page template Category: Finance & Tax Niche: ca...

Offer finance to customers: interest‑free plans vs Kanda, Vendigo and Novuna explained

Offer finance to customers: interest‑free plans vs Kanda, Vendigo and Novuna explained Category: Finance & Tax • Niche: customer finance, interest...

How to add ULEZ or Clean Air Zone charges to your invoice (VAT and reverse charge explained)

Category: Finance & Tax • Niche: VAT, ULEZ/CAZ, invoicing, domestic reverse charge, job costing, Xero, QuickBooks Contents {#contents} - Quick an...

HMRC Advisory Fuel Rates made simple for construction firms: vans vs company cars, EV home vs public charging, and clean Xero/QuickBooks workflows

HMRC Advisory Fuel Rates made simple for construction firms: vans vs company cars, EV home vs public charging, and clean Xero/QuickBooks workflows ...

AI cash flow forecasting for trades: set it up with Xero or QuickBooks and GoCardless

AI cash flow forecasting for trades: set it up with Xero or QuickBooks and GoCardless Category: Finance & Tax • Niche: cash flow, AI forecasting, ...

Can't verify a subcontractor in CIS? Fix error 7912 and unmatched checks in Xero, QuickBooks and Sage

Can't verify a subcontractor in CIS? Fix error 7912 and unmatched checks in Xero, QuickBooks and Sage Category: Finance & Tax • Niche: CIS, HMRC, ...

Making Tax Digital for Income Tax for self‑employed trades: deadlines, software and a simple setup

Making Tax Digital for Income Tax for self‑employed trades: deadlines, software and a simple setup <img src="https://vpzqhqqkbkbzibzvzuxv.supabase...

Stop chargebacks on site: photos, signatures and payment flows that protect your jobs

Stop chargebacks on site: photos, signatures and payment flows that protect your jobs Category: Finance & Tax Niche: chargebacks, disputes, card ...

VAT threshold for trades: rolling 12‑month calculator and simple workflow to avoid fines

VAT threshold for trades: rolling 12‑month calculator and simple workflow to avoid fines Category: Finance & Tax Niche: VAT, threshold, rolling 1...

VAT bad debt relief for construction: step-by-step for Xero and QuickBooks (with templates)

VAT bad debt relief for construction: step-by-step for Xero and QuickBooks (with templates) Category: Finance & Tax Niche: VAT, bad debt relief, ...

Set up VAT self-billing for CIS subcontractors: Xero and QuickBooks step-by-step

Set up VAT self-billing for CIS subcontractors: Xero and QuickBooks step-by-step Category: Finance & Tax Niche: VAT self-billing, CIS, Xero, Quic...

Xero and QuickBooks bank feeds: the simple setup for UK trades and how to fix the 90-day reconnect

Xero and QuickBooks bank feeds: the simple setup for UK trades and how to fix the 90-day reconnect Category: Finance & Tax Niche: Open banking, b...

CIS payment and deduction statements: what to include and how to send them in Xero and QuickBooks

CIS payment and deduction statements: what to include and how to send them in Xero and QuickBooks Category: Finance & Tax • Niche: CIS, HMRC, Xero...

HMRC VAT inspection checklist for construction: records to keep, reverse charge evidence and how to pass first time

HMRC VAT inspection checklist for construction: records to keep, reverse charge evidence and how to pass first time Category: Finance & Tax • Nich...

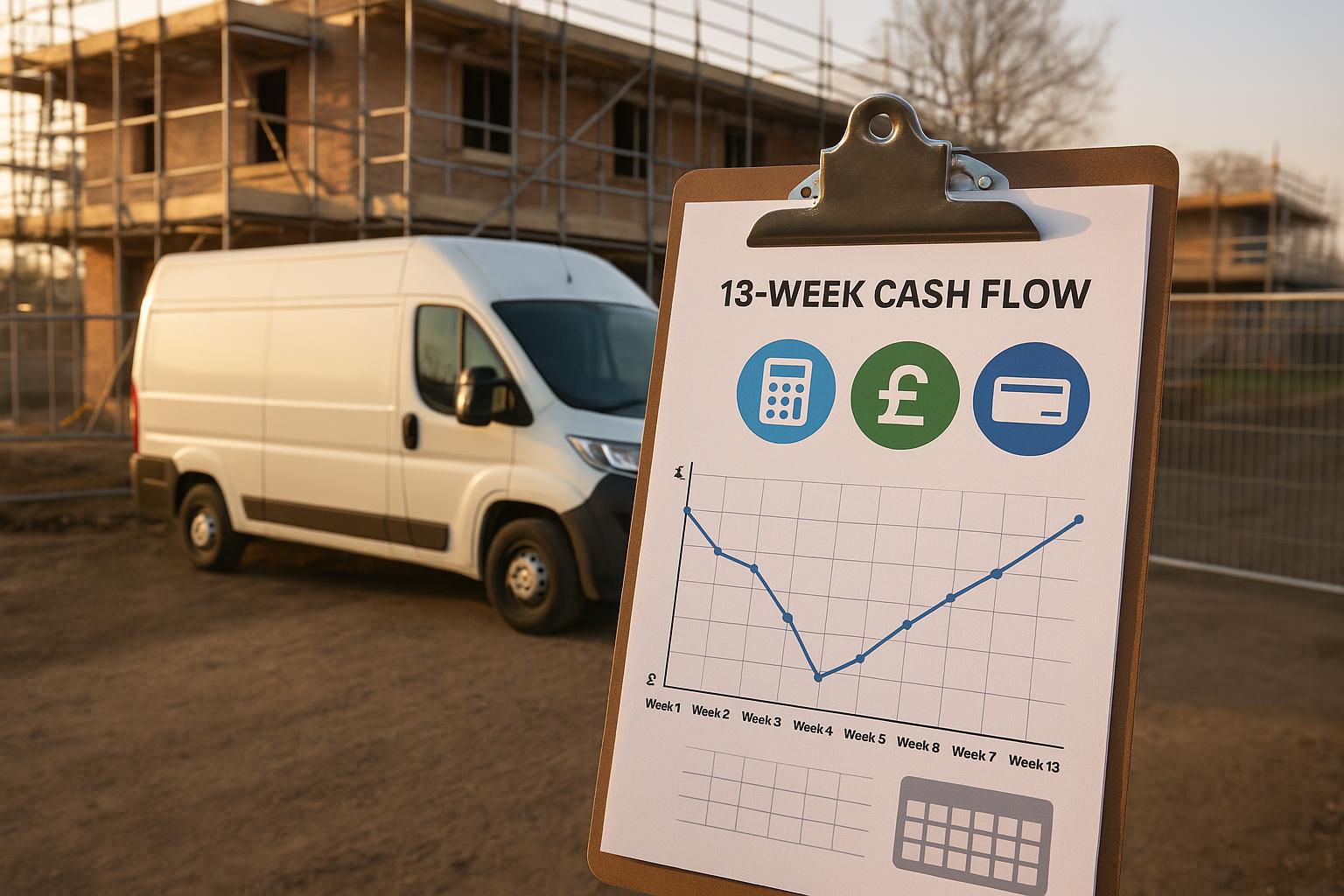

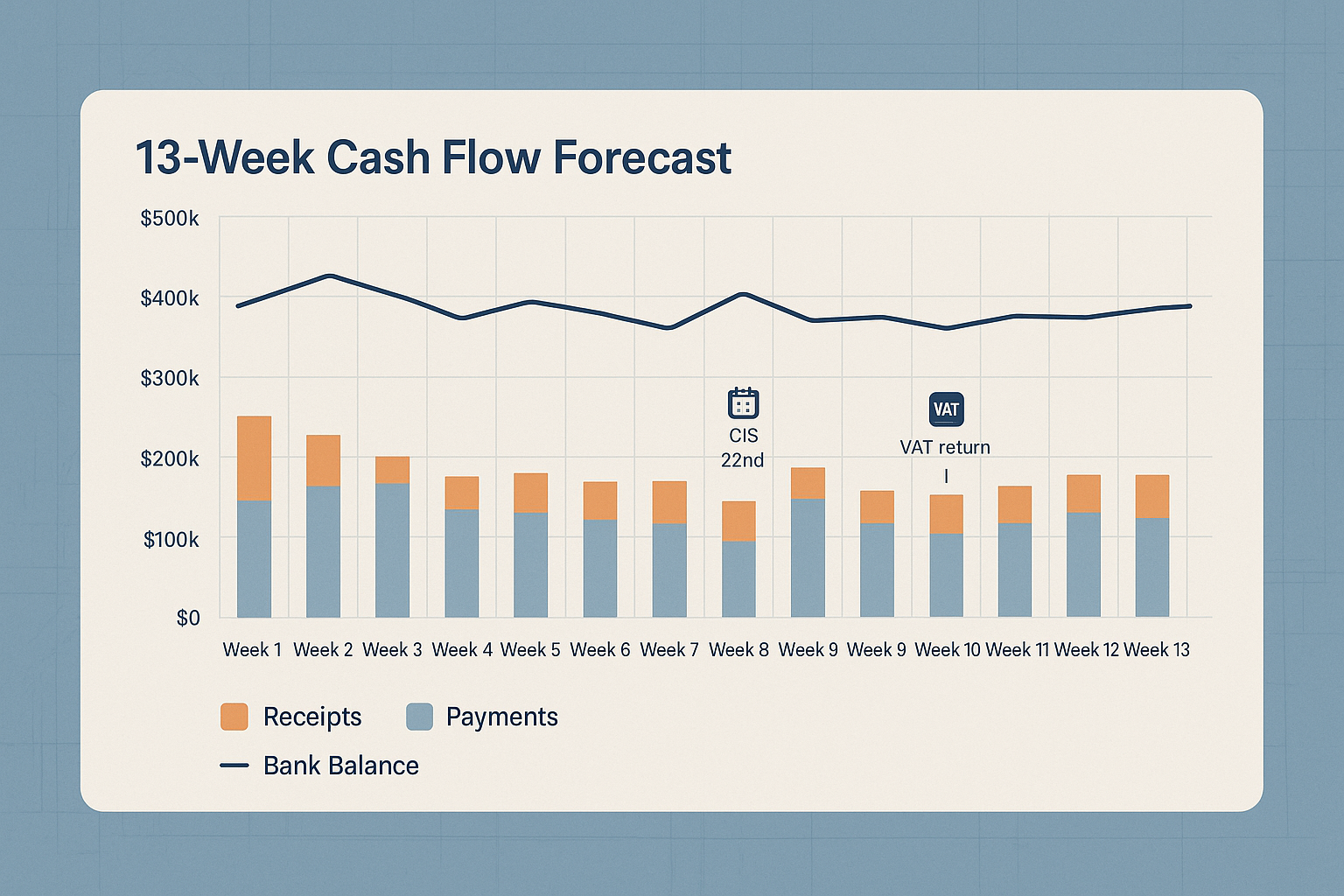

13‑week cash flow for trades: simple UK template with CIS, VAT and retentions

13‑week cash flow for trades: simple UK template with CIS, VAT and retentions Category: Finance & Tax • Niche: cash flow, CIS, VAT, retentions, Xe...

HMRC mileage rates 2025 for trades: what to claim, VAT on fuel and simple Xero/QuickBooks automations

Category: Finance & Tax • Niche: Mileage, expenses, HMRC, automations Contents {#contents} - Quick answer: the rates you can use in 2025 to 2026 ...

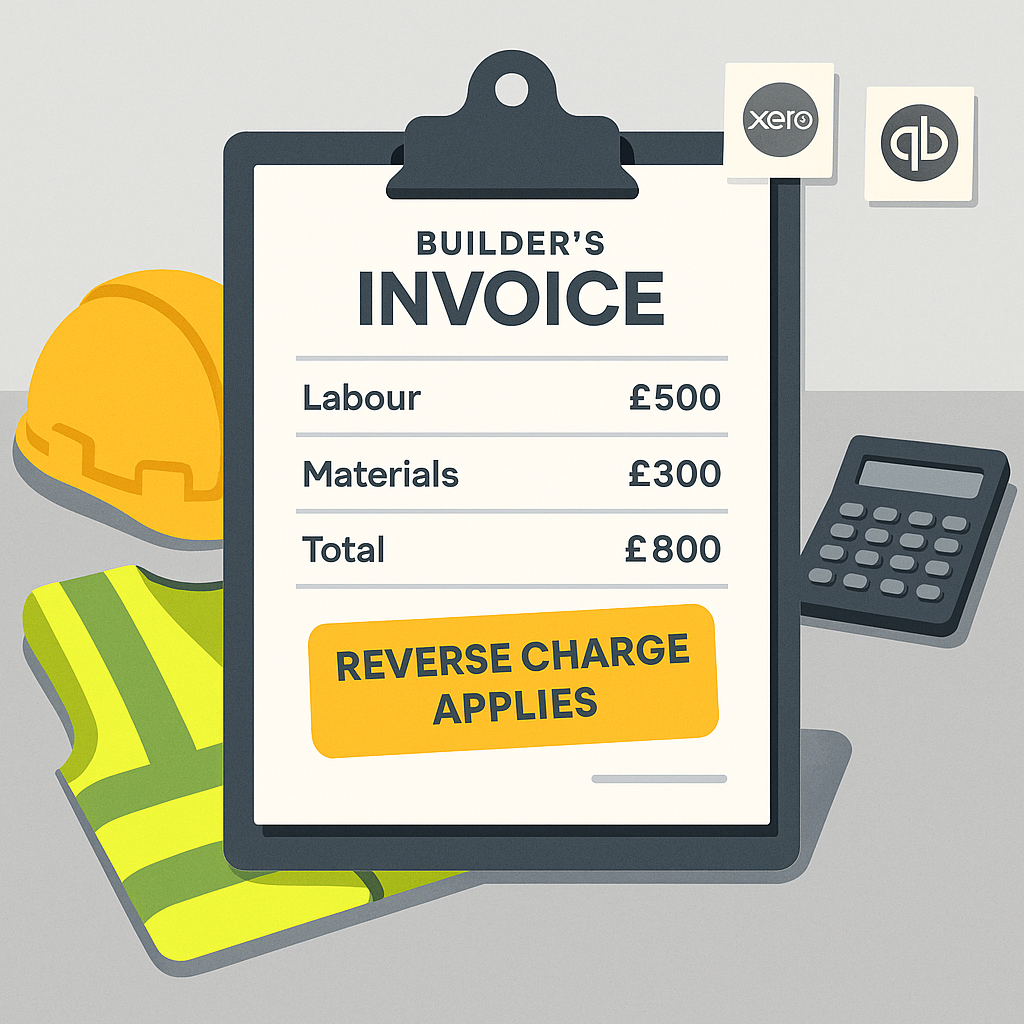

Domestic Reverse Charge on mixed invoices: how to handle labour and materials in Xero and QuickBooks

Domestic Reverse Charge on mixed invoices: how to handle labour and materials in Xero and QuickBooks Category: Finance & Tax • Niche: VAT, Domesti...

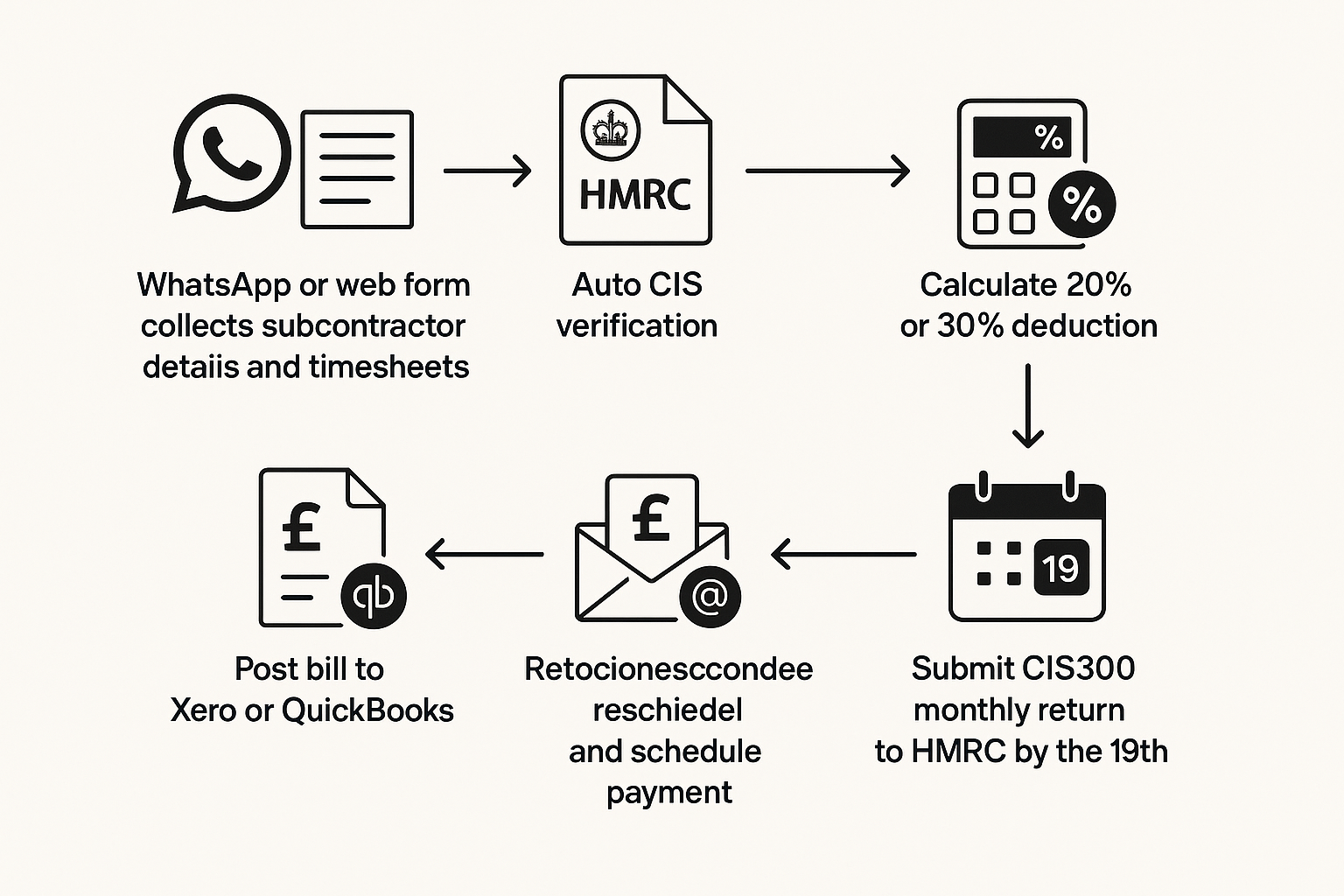

CIS automation playbook: collect timesheets, auto‑verify subs, email statements and file your CIS300 on time

CIS automation playbook: collect timesheets, auto‑verify subs, email statements and file your CIS300 on time Category: Finance & Tax • Niche: CIS,...

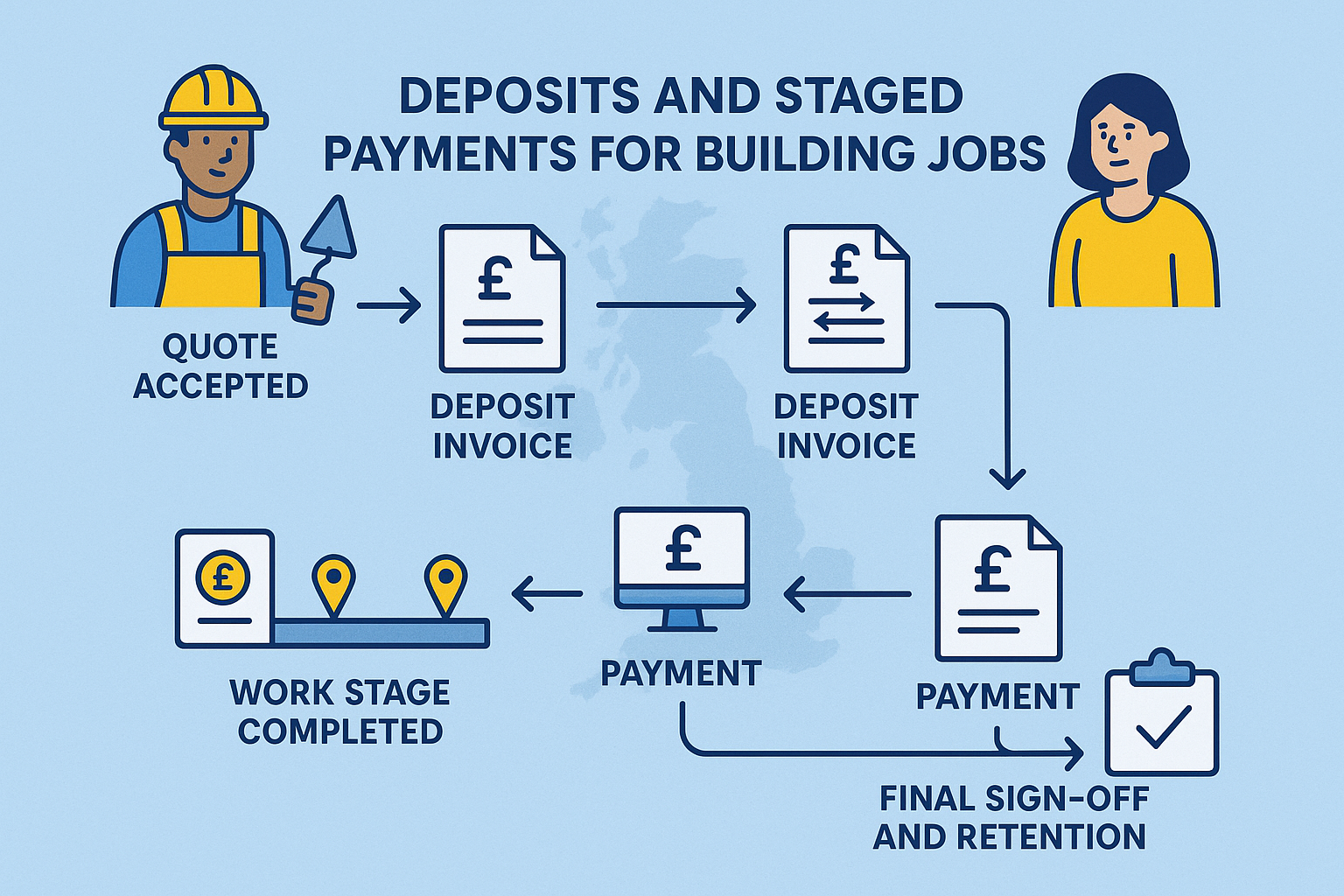

Deposits, staged payments and progress invoices for building jobs: what’s normal and how to set it up

Deposits, staged payments and progress invoices for building jobs: what’s normal and how to set it up Category: Finance & Tax • Niche: Payments, c...

0% VAT on energy‑saving materials: what installers need to know, invoice wording and examples

Category: Finance & Tax • Niche: VAT, energy efficiency, heat pumps, solar - Contents: Quick answer • What counts • Decision flow • Invoice wordin...

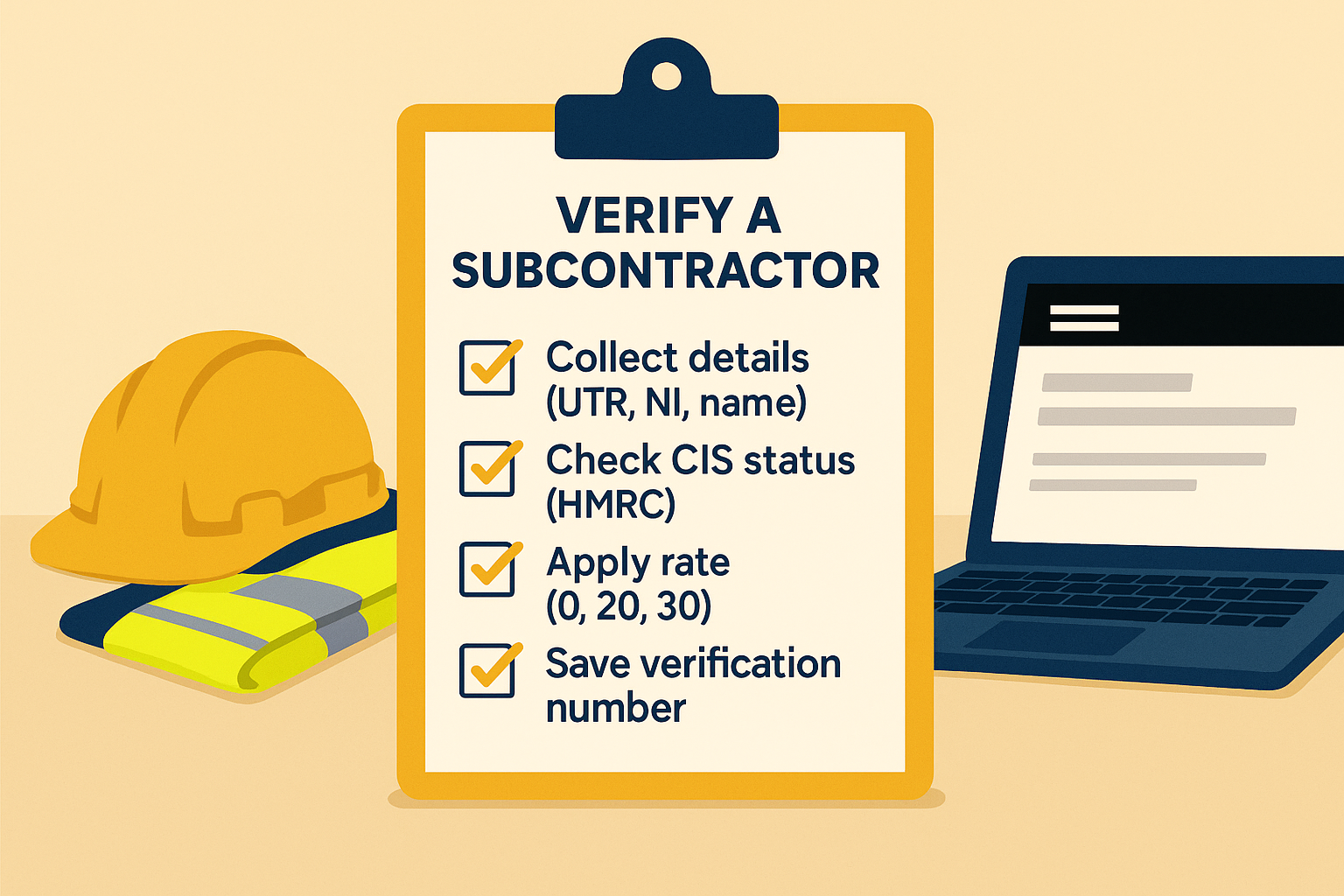

CIS subcontractor verification: what to collect, where to check and a simple automation to log rates

CIS subcontractor verification: what to collect, where to check and a simple automation to log rates Category: Finance & Tax • Niche: CIS, HMRC, a...

CIS monthly return: deadlines, how to file in Xero and QuickBooks, penalties and nil returns

CIS monthly return: deadlines, how to file in Xero and QuickBooks, penalties and nil returns - Jump to: Who this is for • Quick answer • CIS timel...

Domestic reverse charge VAT for construction: simple checklist, invoice wording and VAT return boxes

Domestic reverse charge VAT for construction: simple checklist, invoice wording and VAT return boxes - Jump to: Who this is for • What the reverse...

Xero invoice reminders UK: best settings, copyable chase emails and a 30‑minute weekly routine for trades

Xero invoice reminders UK: best settings, copyable chase emails and a 30‑minute weekly routine for trades - Jump to: Who this is for • Quick wins ...

VAT for Trades: Flat Rate vs Standard in 10 Minutes

Quick guide to understanding VAT options for UK trades businesses.