CIS automation playbook: collect timesheets, auto‑verify subs, email statements and file your CIS300 on time

CIS automation playbook: collect timesheets, auto‑verify subs, email statements and file your CIS300 on time

Category: Finance & Tax • Niche: CIS, automations, Xero/QuickBooks, subcontractors

Contents

- Quick answer

- Who this is for

- How the CIS automation flow works

- Step-by-step setup

- Simple flowchart you can copy

- Xero vs QuickBooks notes

- HMRC links and deadlines

- What people ask

Quick answer

If you pay subcontractors under CIS, you can automate most admin:

- Collect sub details and weekly timesheets with a short WhatsApp or web form

- Auto‑verify subs with HMRC and log the deduction rate

- Calculate 20 percent or 30 percent deduction from each payment

- Email a CIS payment and deduction statement PDF each month

- Post supplier bills to Xero or QuickBooks so you can reconcile and pay

- File your CIS300 by the 19th every month and keep records tidy

This usually cuts CIS admin time from hours to minutes per month and reduces errors that trigger penalties.

Who this is for

- Main contractors and small builders paying subcontractors under CIS

- Trades using Xero or QuickBooks who want fewer manual steps

- Office managers who chase timesheets and spend late nights on the 18th

How the CIS automation flow works

- Intake and timesheets

- Use a simple form link shared on WhatsApp to collect: name, UTR, NI, company details (if LTD), day rate or unit rate, bank details, and weekly hours. File uploads for photo ID and right‑to‑work if you also onboard subs. Store in your drive or job system.

- HMRC verification

- Verify every new sub before payment and re‑verify if you haven’t paid them in the current or previous two tax years. HMRC returns 20 percent, 30 percent or gross.

- Where: use the HMRC CIS online service to verify and to file returns: Sign in to CIS online.

- Calculate deductions

- Apply HMRC’s rate to the labour element only. Materials, VAT and allowable costs are excluded from the deduction.

- Keep your price book clear so labour vs materials are separated.

- Payment and deduction statements

- For each sub you pay in a tax month (6th to 5th), generate and email a CIS payment and deduction statement. Most accounting packages can produce these when set up correctly.

- If no subs were paid, submit a nil return or tell HMRC no return is due.

- Post bills to accounts

- Create a supplier bill per sub with the gross labour, materials, and the CIS deduction as a separate line, so the net payable is correct.

- Reconcile and pay

- Match bank payments to the bills so your CIS control account and creditors stay clean.

- File the CIS300 return

- File your CIS300 by the 19th for the previous tax month. Late filings rack up penalties. Use HMRC online or compatible software.

Step-by-step setup

- Build your intake and timesheet form

- Tools: Google Forms, Microsoft Forms, Typeform or your job app. Include consent wording for storing personal data and why you need it (GDPR).

- Fields to include: Name, UTR, NI number, company name and number (if LTD), address, mobile, email, bank details, day rate, job reference, hours or units per week, materials claim if applicable, and file uploads for ID.

- Create an HMRC verification checklist

- Before first payment, verify the sub and record: HMRC verification number, rate returned, date verified, who did it.

- Keep the record in your supplier file and on the job if you pay per job.

- Guidance: GOV.UK on verification and monthly returns: Verify subcontractors and File monthly returns.

- Template your CIS statement

- Your statement must show: your name and UTR, the sub’s details, gross labour, materials, deduction rate, amount deducted, and the tax month.

- Produce as a PDF and email automatically when you approve the bill each month.

- Xero and QuickBooks setup

- Xero: enable CIS, mark suppliers as CIS subcontractors, set the deduction rate and map a CIS control account so deductions post correctly.

- QuickBooks: tick This supplier is a CIS subcontractor on the supplier record and enter UTR and verification details. Use the built‑in CIS statements.

- See related Academy guides for deeper platform steps: CIS monthly return: deadlines, how to file in Xero and QuickBooks and CIS subcontractor verification: what to collect, where to check and a simple automation to log rates.

- Automate the admin

- Trigger: when a sub submits a weekly timesheet form, create or update a draft bill. If verification is missing, alert the office.

- When you approve a bill, auto‑generate the CIS statement PDF and email it to the sub.

- On the 6th of each month, run a checklist to gather last month’s statements; on the 18th, remind to file the CIS300 for the tax month ending on the 5th.

- File the CIS300 on time

- File by the 19th. You can file via HMRC online or via your payroll/accounting software if supported. Keep a submission receipt.

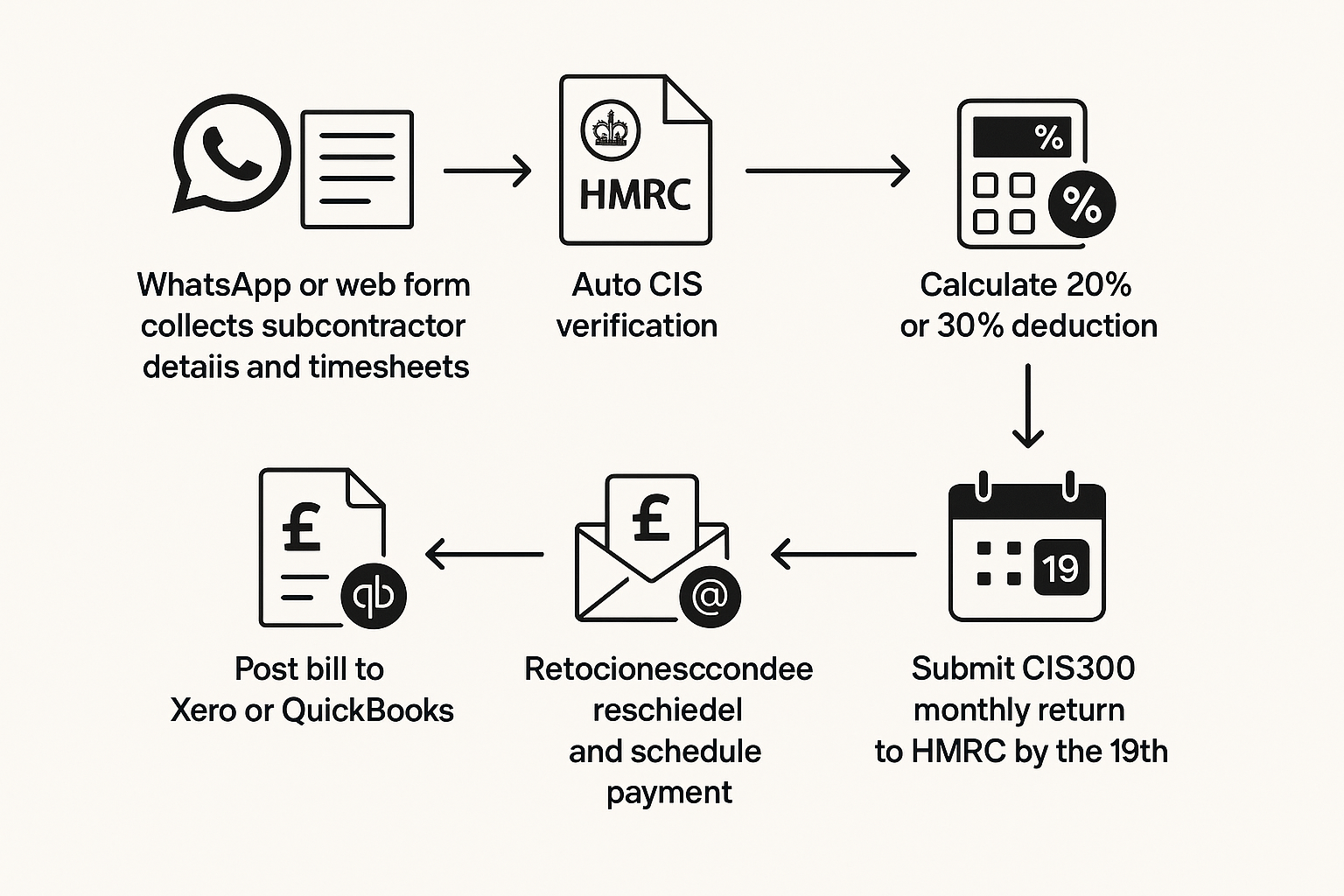

Simple flowchart you can copy

- Sub submits details and timesheets → Check verification status → If not verified, verify via HMRC and store rate → Create draft bill (labour separate from materials) → Approve bill → Auto‑email CIS statement → Reconcile payment → File CIS300 by the 19th → Archive statements and receipts.

Xero vs QuickBooks notes

- Both support CIS suppliers and CIS statements when configured.

- Xero: make sure your CIS control account is mapped so deductions don’t get lost in suspense. Check Xero’s CIS reports line up to your CIS300 figures.

- QuickBooks: use the CIS reports and the supplier’s UTR field so deduction statements pull the right details.

- Cross‑read: ServiceM8 ↔ Xero: DRC and CIS workflows.

HMRC links and deadlines

- What CIS is: GOV.UK overview

- Verify subs: GOV.UK verify subcontractors

- File monthly returns: GOV.UK file your monthly returns

- Sign in to HMRC CIS online: GOV.UK CIS online service

Deadline reminders

- Tax month runs 6th to 5th

- File CIS300 by the 19th

- Pay CIS deductions to HMRC by the 22nd if paying electronically (19th by post). Always check the current HMRC page for any changes.

What people ask

Do I have to submit a CIS return if I didn’t pay any subs last month?

Yes. You must either submit a nil return or tell HMRC no return is due for that month. See HMRC’s monthly returns guidance.

What rate should I use? 20 percent or 30 percent?

Use the rate HMRC gives you when you verify the subcontractor: 20 percent if registered, 30 percent if not. Some subs are authorised for gross payment (0 percent) — HMRC will tell you.

What goes on a CIS payment and deduction statement?

Your details and UTR, the sub’s details, the tax month, gross labour, materials, rate applied and amount deducted. Keep a copy for your records.

Can I automate the verification step?

You still have to use HMRC’s service to verify, but you can track which subs need verifying and store the result. HMRC also offers an API that some software uses to verify and file returns.

How do I separate labour and materials so I don’t over‑deduct?

Use separate lines on quotes, purchase orders and bills. Keep materials receipts attached. Only apply CIS to the labour amount.

How does this fit with GDPR?

Minimise data you collect, explain why you collect it, store it securely, and restrict access. Include a privacy notice link on your forms.

Call to action

Want to slash training times and increase revenue per Engineer? Join our Waitlist: https://trainar.ai/waitlist

Share this article

Category

Financial management and tax guidance for trades

Ready to Transform Your Business?

Join the TrainAR beta and start using AR training in your business.

Join Beta ProgramStay Updated

Get weekly insights and new articles delivered to your inbox.

Comments (0)

Leave a Comment

No comments yet

Be the first to share your thoughts on this article!

Related Articles

Cash flow forecasting for trades in Xero or QuickBooks: simple setup, open banking tips and a one‑page template

Cash flow forecasting for trades in Xero or QuickBooks: simple setup, open banking tips and a one‑page template Category: Finance & Tax Niche: ca...

Offer finance to customers: interest‑free plans vs Kanda, Vendigo and Novuna explained

Offer finance to customers: interest‑free plans vs Kanda, Vendigo and Novuna explained Category: Finance & Tax • Niche: customer finance, interest...

How to add ULEZ or Clean Air Zone charges to your invoice (VAT and reverse charge explained)

Category: Finance & Tax • Niche: VAT, ULEZ/CAZ, invoicing, domestic reverse charge, job costing, Xero, QuickBooks Contents {#contents} - Quick an...

Cash flow forecasting for trades in Xero or QuickBooks: simple setup, open banking tips and a one‑page template

Cash flow forecasting for trades in Xero or QuickBooks: simple setup, open banking tips and a one‑page template Category: Finance & Tax Niche: ca...

Offer finance to customers: interest‑free plans vs Kanda, Vendigo and Novuna explained

Offer finance to customers: interest‑free plans vs Kanda, Vendigo and Novuna explained Category: Finance & Tax • Niche: customer finance, interest...

How to add ULEZ or Clean Air Zone charges to your invoice (VAT and reverse charge explained)

Category: Finance & Tax • Niche: VAT, ULEZ/CAZ, invoicing, domestic reverse charge, job costing, Xero, QuickBooks Contents {#contents} - Quick an...